Apart from the recent market volatility, a new study shows significant growth in account balances for 401(k) plan participants who consistently participate—especially for younger workers.

![]()

According to the study from the Employee Benefit Research Institute (EBRI) and the Investment Company Institute (ICI)—What Does Consistent Participation in 401(k) Plans Generate? Changes in 401(k) Plan Account Balances, 2016–2020—account balances for consistent 401(k) plan participants rose by double-digits for all participant groups.

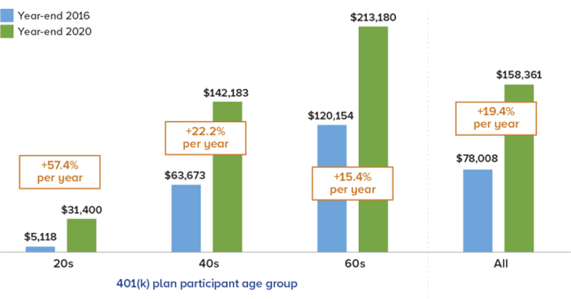

The average 401(k) plan account balance for consistent participants rose each year from year-end 2016 through year-end 2020. Overall, increases reflect a compound annual average growth rate of more than 19% over the period, with the average account balance rising from $78,008 at year-end 2016 to $158,361 at year-end 2020.

The median 401(k) plan account balance for consistent participants increased at a compound annual average growth rate of more than 28% over the period, to $62,134 at year-end 2020.

As one might presume, the percent change in balance for participants in younger age groups was influenced by the relative size of their contributions to their account balances. Younger 401(k) participants, or those with smaller year-end 2016 balances, experienced higher growth in account balances compared with older participants, who tend to have larger balances on average.

The percent change in average 401(k) plan account balance of participants in their 20s was heavily influenced by the relative size of their contributions to their account balances and increased at a compound average growth rate of 57.4% per year between year-end 2016 and year-end 2020.

Changes in 401(k) Plan Account Balances Among Consistent 401(k) Participants

Average 401(k) plan account balance and percent change compound annual average growth rate 2016–2020

Source: Tabulations from EBRI/ICI Participant-Directed Retirement Plan Data Collection Project

Consistent Savers vs. Broader Group

Diving deeper into the data further highlights the accumulation effect of ongoing 401(k) participation. Consider that, at year-end 2020, 22.2% of the consistent group had more than $200,000 in their 401(k) plan accounts at their current employers, while another 15.8% had between $100,000 and $200,000. In contrast, in the broader EBRI/ ICI 401(k) database, only 11.4% had accounts with more than $200,000, and 9% had between $100,000 and $200,000.

Reflecting their higher average age and tenure, the study notes that the consistent group also had average and median account balances that were much higher than the average and median account balances of the broader EBRI/ICI 401(k) database.

“Exploring the changes in account balances among consistent 401(k) plan participants highlights the strength of the 401(k) plan as a powerful savings tool,” notes Sarah Holden, senior director, Retirement and Investor Research, ICI.

To that end, at year-end 2020, the average 401(k) plan account balance of the consistent group was $158,361, more than 80% higher than the average account balance of $87,040 among participants in the entire EBRI/ICI 401(k) database. The median 401(k) plan account balance among the consistent participants was $62,134 at year-end 2020, nearly three and a half times the median account balance of $17,961 for participants in the entire EBRI/ICI 401(k) database.

Equity Shifts

Meanwhile, the study also not surprisingly shows that 401(k) participants tend to concentrate their accounts in equity securities. On average at year-end 2020, more than two-thirds of consistent 401(k) participants’ assets were invested in equities—through equity funds, the equity portion of target date funds, the equity portion of non–target date balanced funds, or company stock.

“Younger 401(k) plan participants tended to be more invested in equity funds and target date funds while older participants were more likely to invest in fixed-income securities,” notes Craig Copeland, EBRI Director of Wealth Benefits Research. “At year-end 2020, 401(k) plan participants in their 20s had allocated 86% of their plan account balances to equities while participants in their 60s had allocated 57% to equities.”

The study is based on the EBRI/ICI database of employer-sponsored 401(k) plans and represents the activity of participants in 401(k) plans of varying sizes—from very large corporations to small businesses—with a variety of investment options. This longitudinal analysis tracks the account balances of 3.7 million 401(k) plan participants who had accounts in the year-end 2016 EBRI/ICI 401(k) database and each subsequent year through year-end 2020.

Original Article Provided By: Why It Pays to Be a Consistent Retirement Saver | National Association of Plan Advisors (napa-net.org)